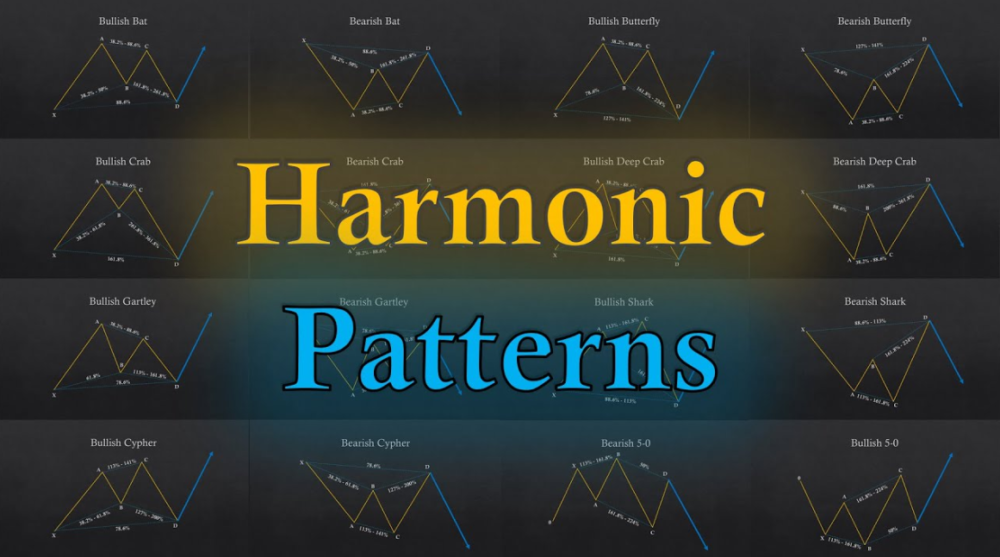

Harmonic patterns are visual and mathematical structures that are thought to provide the most accurate prediction of price movement. They do this because they can put into perspective what traders need in the future. Harmonic patterns are less likely to send false signals than many other technologies. This is because they need to change in the right ways for them to be valid. Visit MultiBank Group

Harmonic patterns can be layered on top of visual patterns to produce new harmonic patterns. Looking at the market over different time periods can make it easier to pick out signals that work well with one another and give you a better understanding of how the market is moving.

Harmonic Pattern Trading Strategies

Harmonic Pattern Trading Strategies are based on the idea that markets tend to repeat themselves. The price movements of the past can be used as a guide to predict future price movements. Five popular harmonic pattern trading strategies include:

· Harmonic Patterns Reversal

· Harmonic Patterns Continuation

· Harmonic Patterns Momentum

· Harmonic Patterns Trend Reversal

· Harmonic Patterns Trend Continuation

Benefits of Harmonic Patterns

· The data and conditions are completely clear and precise. The trader is concerned with accurate ratios, pivot points, and levels. They’re looking for opportunities to enter the market.

· One of the benefits of wave patterns is that they can be reliably made and have truth behind them. These two facts about the pattern-making process will show us how reliable wave patterns are. You can usually compare complicated forms to a lot of similar ones with their own individual ratios.

· Harmonic patterns are found on charts that occur with enough consistency to be incorporated into trading strategies.

· When it comes to harmonic patterns and market trends, they cover a wide range of phenomena across different events.

· You can mix harmonic patterns with other technical analysis tools to make them more effective.

Drawbacks of Harmonic Patterns

· It can be difficult to understand how the patterns of harmonic trading work, and often novice traders make poor decisions because they’re unable to fully take in all the information.

· It is not always possible to see the pattern when detecting price fluctuation. The Shark Pattern, for example, can be reversed and become something completely different: the 5-0 pattern.

· It’s not possible to identify harmonic patterns automatically as the technology is not accurate enough yet.

· Patterns that are opposite to each other can be made with the same chart area but on different timescales.

· There are surprisingly few patterns in real trading charts that satisfy stringent conditions for aspect ratio. As a result, evaluation is more subjective and the predictions less accurate.

What are the Best Harmonic Patterns to Follow?

There are many harmonic trading strategies to choose from and it is important to find one that suits you best. For instance, if you are a short-term trader, then the best strategy for you would be Price Action Patterns. If you are looking for longer-term trades, then Harmonic Patterns would be your best choice. There are several harmonic patterns to follow in the stock market. But there are a few that you should focus on the most.The best harmonic patterns to follow are: Know mores dubai best traders

· Double Bottom Reversal Pattern

· Head and Shoulders Pattern

· Broadening Top Pattern

· Rounding Bottom Pattern