A Fed Rate Hike is looming over the nation’s financial markets. The Fed last increased interest rates in March and thought that inflation and growth were strong enough to warrant another increase. However, fears of a recession loom over the nation. The next possible fed rate hike could be in 2022. In this article, we will discuss the implications of a hike on short-term interest rates and financial markets. This article will also explain how the Fed’s mandate to maximize employment while keeping prices stable will be implemented in practice.

Fed fund’s rate range

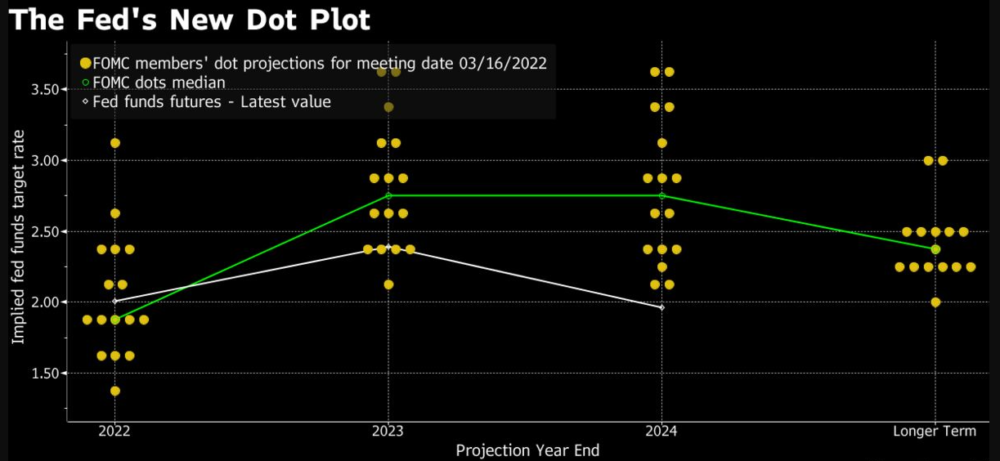

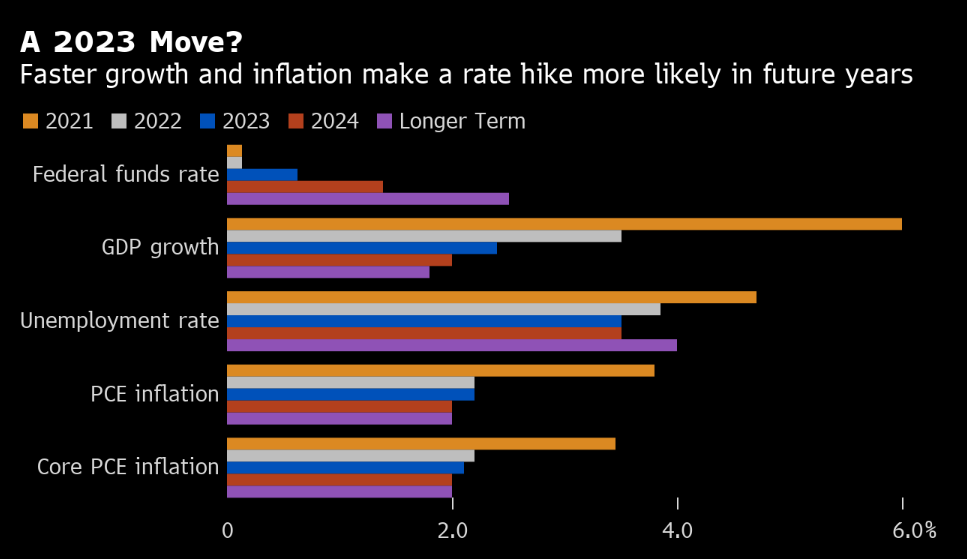

In a statement released Wednesday, the Federal Reserve raised interest rates by three-quarters of a percentage point. Although the increase is not a surprise, it was accompanied by a downgrade of the Fed’s inflation forecast. In their quarterly economic projections, the Fed includes the federal funds rate. According to the projection, the federal funds rate will reach close to four percent by the end of 2022. The Fed also plans to increase the rates aggressively in July and September. And tentatively plan on raising rates by one-quarter point the rest of the year.

The range is based on a number of factors, including the number of active participants in the market and inflation expectations. The Fed’s target range is a monetary policy tool that is updated every day. This chart gives the probability of 25 basis points of rise or cut in the next three-month period. The data is effective as of the day it is published. The Fed is continuing to reduce its balance sheet and plans to hike the federal funds rate over time.

Fed’s mandate to maximize employment while keeping prices stable

While the mandate to maximize employment and keep prices stable has been in place since the 1970s, the definition of maximum employment has changed a few times. Before the FOMC adopted its new mandate, the two key thresholds were 3 percent unemployment and 2 percent inflation. In other words, high unemployment and low inflation are not cause for concern, but high inflation does. This is the reason why the Fed does not pursue 0% unemployment, as many economists have advocated.

Moreover, the Fed also aims for low inflation – 2% in this case – in the long term. Low inflation is beneficial for the economy, since people can hold their money without worrying about depreciation. For example, at a 2 percent annual inflation rate, a dollar buys 2 percent less goods than it did a year ago. However, a 10-percent inflation rate would be unmanageable. Low inflation means that consumers’ plans for purchasing goods are unaffected and businesses can borrow without fear of loss of profits. Thus, the economy can function smoothly with stable prices.

Impact on short-term interest rates

The Fed has always raised or lowered its federal funds rate to counteract swings in the economy. The Fed’s actions directly affect interest rates on mortgages and consumer loans. The recent rate hikes, however, have caused some concern among market participants. The Fed’s actions slow overall demand and push the economy into a recession. As a result, the S&P 500 Index recently entered bear market territory and hit a new low.

While the Fed is not yet sure when it will stop raising rates. It has already hiked the benchmark short-term rate by 75 basis points. The move reflects the Fed’s desire to stabilize prices without hurting employment. The rate hikes were the largest in one year and came on the heels of a major shift in the economy. Currently, the federal-funds rate range is between 2.25% and 2.50%. The Fed is expected to continue raising rates until it sees signs that inflation has fallen below its 2% target.

Impact on financial markets

In a recent statement, Federal Reserve Chairman Jerome Powell stated that the central bank aims to have interest rates in restrictive territory by the end of this year. And that it will continue to hike rates at an incremental pace of 50 basis points until inflation is contained. Chairman Powell cited the impact of the Russia-Ukraine war, COVID-19 lockdowns in China, and wage pressures as contributing factors in the rise of inflation.

The first half of 2022 saw a steep drop in stock prices around the globe, as a result of high inflation and war in Europe. The Federal Reserve’s aggressive policy rate hikes were accompanied by a sharp decline in stock prices, while inflation was at its highest level in nearly three decades. Some economists believe the Fed should move even faster to curb rising inflation and prevent recession, but there are many factors at play.